Spokesman Report

Islamabad: Reforms Group of the Pakistan Petroleum Dealers Association (PPDA) has successfully convinced the government that imposing a 0.5 percent advance turnover tax on petroleum retailers was a misinterpretation of the law.

The delegation of dealers held marathon meetings with top government functionaries and convinced them that 0.5 percent advance turnover tax was double taxation as the outlets were already paying advance fixed withholding tax at Rs1.04 per liter as final income tax.

Dealers supported the new taxation measure introduced by the government to boost revenue and cover its financial shortfall as challenging revenue collection targets will help it clinch an IMF bailout but clarified that filling stations could not survive the blow, said Hassan Shah, Spokesman of PPDA.

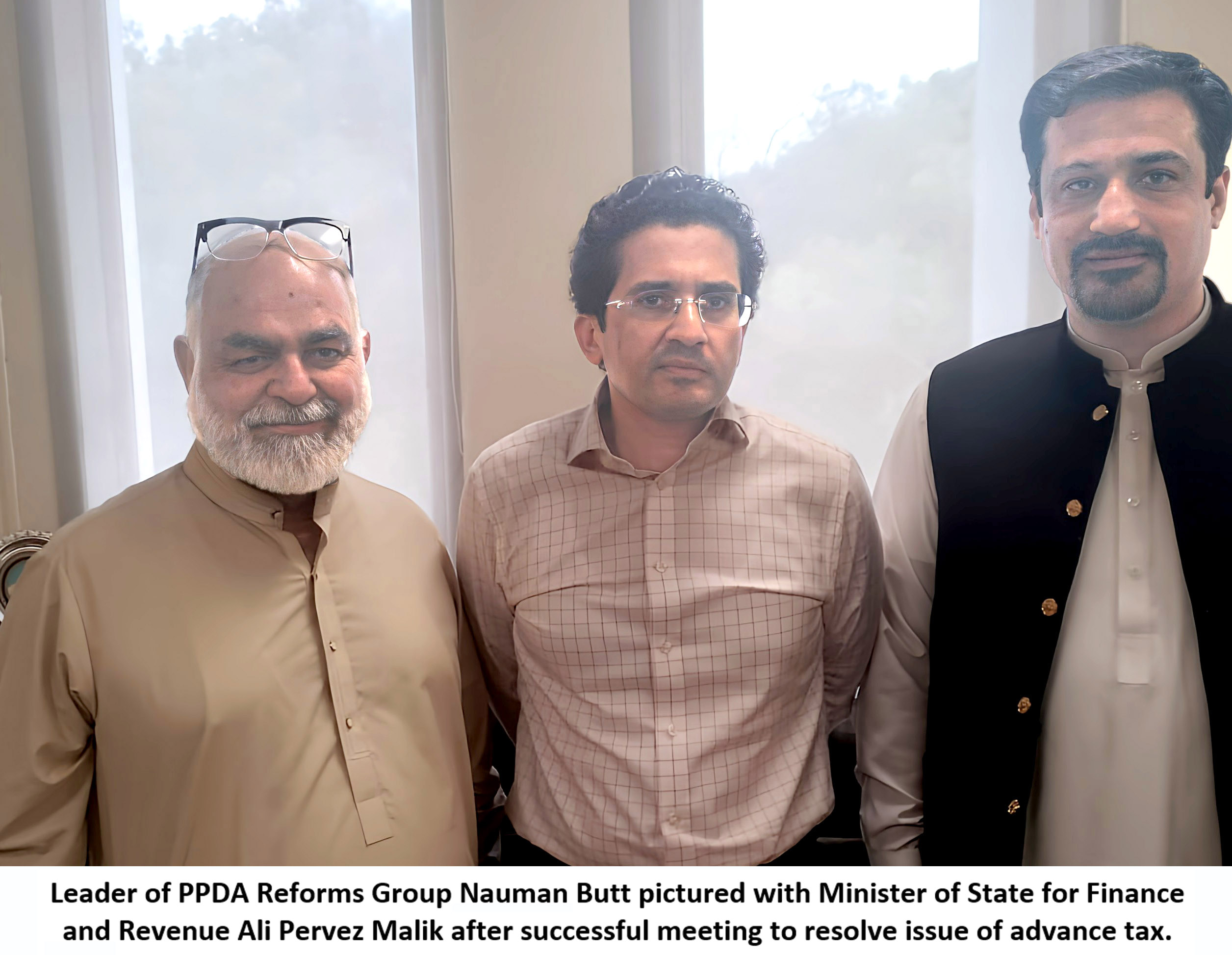

Dealers met with Minister of State for Finance & Revenue Ali Pervez Malik, Federal Board of Revenue (FBR) Chairman Amjed Zubair Tiwana, Petroleum Secretary Mr. Momin Agha, Chairman OGRA, MD PSO and other officials, he added.

Dealers told government officials that imposing turnover tax through the Finance Act 2024-25, passed by the Parliament and endorsed by the President of Pakistan, has left this anomaly, which must be resolved, he informed.

The new turnover tax would strangle petroleum retailers as petrol pumps were already operating at meager margins, and record inflation had made the retail business unviable, dealers said.

Hassan Shah said that on July 05, the Ministry of Energy (Petroleum Division) asked the FBR to clarify the applicability of section 236H of the Income Tax Ordinance.

In his reply to the Ministry of Energy, Secretary Income Tax Policy of FBR Muhammad Sajid Ahmad, in office memorandum (C.No.1(6)S(ITP)/2019/123126-R), clarified that tax collection under section 236H does not apply to dealers/retail outlets as their income falls under Final Tax Regime.

According to Hassan Shah, about 95% of dealers across Pakistan paid no attention to the senseless strike call by some Karachi-based dealers known for their clandestine links with the Oil Marketing Companies.

The government officials involved in the matter were very pleased with the positive attitude of the majority of the dealers. At the same time, they were annoyed with a small group of dealers who have always tried to reap personal benefits through pressure tactics, he informed.

PPDA Reforms Group leaders Nauman Butt, Nadeem Aziz Khan, Khawaja Atif Ahmad, Humayun Khan, and Zaheer Ahmed Paracha said, “We found the minister and all the officials of ministry, OGRA, FBR very patient, tolerant and cooperative and we hope that they will cooperate with us in future as well.”

The advance tax issue has been resolved amicably. The petroleum fuel merchants will continue to strive to obtain their rights by engaging in dialogue with the official circles, said Shah, adding that conversations are always better than political demonstrations.